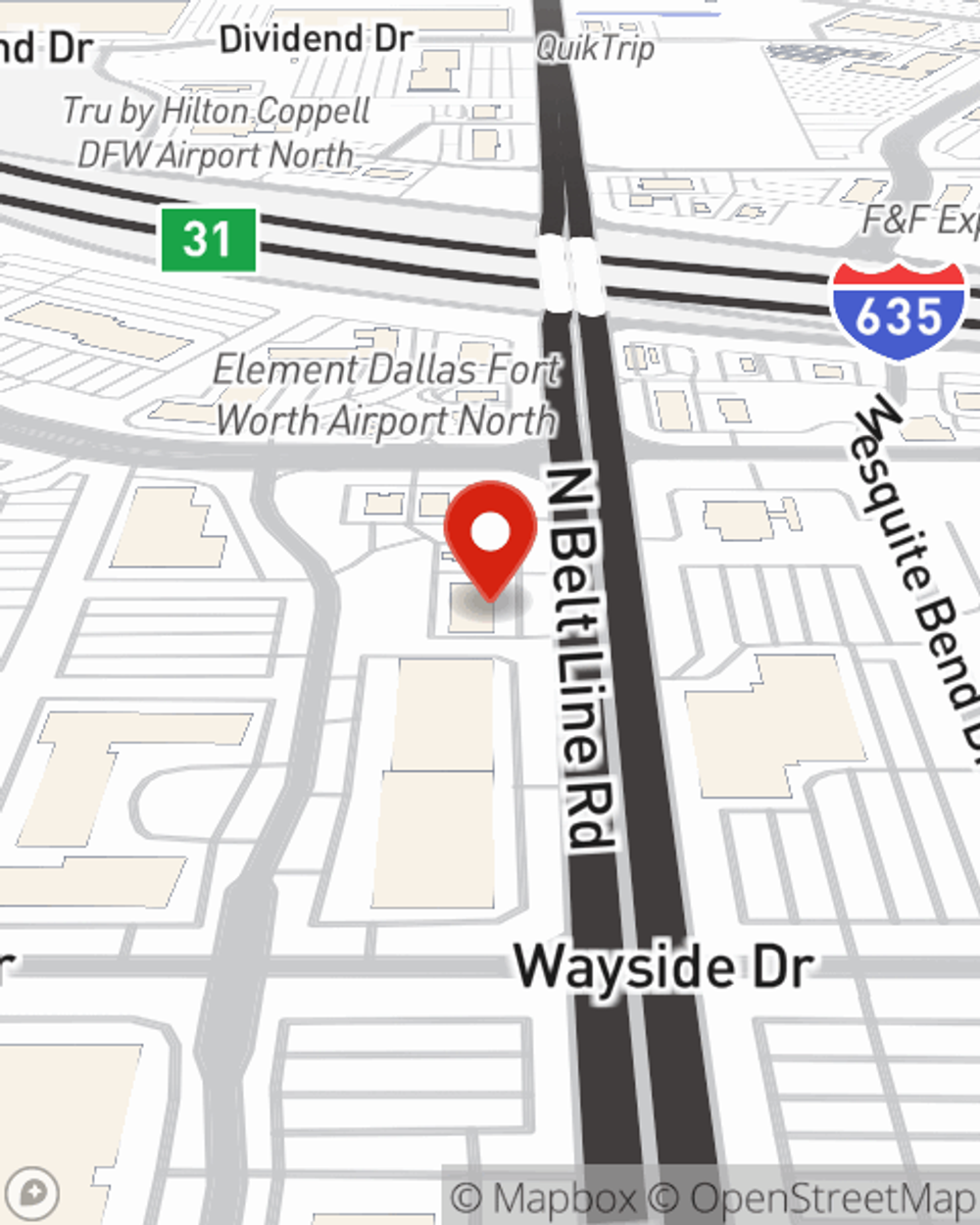

Condo Insurance in and around Irving

Unlock great condo insurance in Irving

State Farm can help you with condo insurance

- Las Colinas

- Coppell

- Dallas

- Grapevine

- Lewisville

- Flower Mound

- Addison

- Denton

- Fort Worth

- Southlake

- Hurst

- Grand Prairie

- Arlington

- Bedford

- Farmers Branch

- Highland Village

- DFW

- Keller

- Highland Park

- University Park

- Turtle Creek

- Preston Hollow

- The Colony

- Little Elm

Home Is Where Your Condo Is

Because your condo is your home base, there are some key details to consider - future needs, needed repairs, neighborhood, and making sure you have the right protection for your home in case of the unexpected. That's where State Farm comes in to offer you quality coverage options to help meet your needs.

Unlock great condo insurance in Irving

State Farm can help you with condo insurance

State Farm Can Insure Your Condominium, Too

You’ll get that and more with State Farm Condo Unitowners Insurance. State Farm has terrific options to keep your largest asset protected. You’ll get coverage options to match your specific needs. Thank goodness that you won’t have to figure that out by yourself. With personal attention and fantastic customer service, Agent Dan Garber can walk you through every step to help create a policy that covers your condo unit and everything you’ve invested in.

Finding the right coverage for your condo is made easy with State Farm. There is no better time than today to get in touch with agent Dan Garber and explore more about your great options.

Have More Questions About Condo Unitowners Insurance?

Call Dan at (972) 621-1115 or visit our FAQ page.

Simple Insights®

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

Simple Insights®

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.