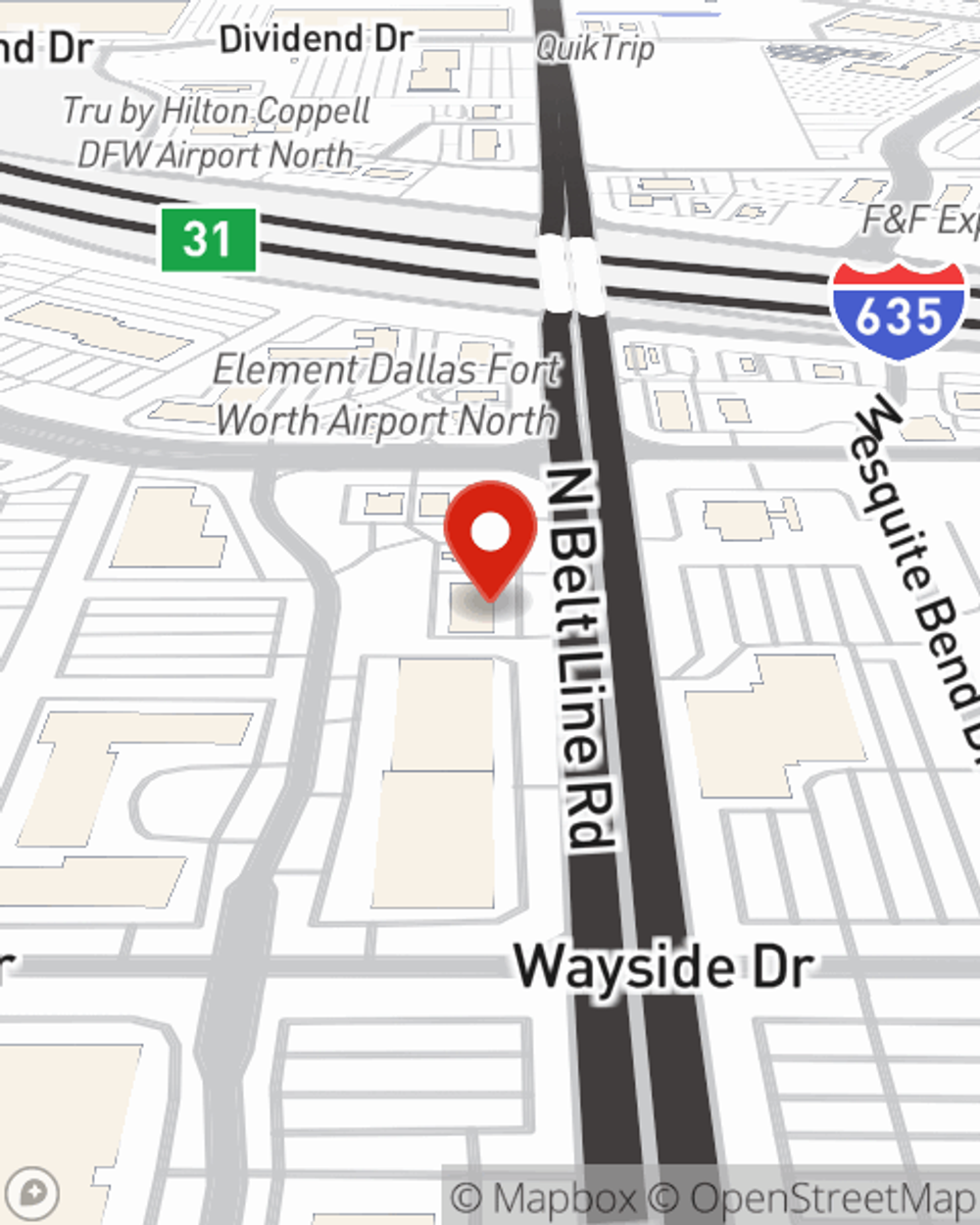

Life Insurance in and around Irving

State Farm can help insure you and your loved ones

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

- Las Colinas

- Coppell

- Dallas

- Grapevine

- Lewisville

- Flower Mound

- Addison

- Denton

- Fort Worth

- Southlake

- Hurst

- Grand Prairie

- Arlington

- Bedford

- Farmers Branch

- Highland Village

- DFW

- Keller

- Highland Park

- University Park

- Turtle Creek

- Preston Hollow

- The Colony

- Little Elm

Check Out Life Insurance Options With State Farm

Taking care of those you love is a big responsibility. You listen to their concerns go to work to provide for them, and take time to plan for the future. That includes getting the proper life insurance to care for them even if you can't be there.

State Farm can help insure you and your loved ones

Don't delay your search for Life insurance

Life Insurance You Can Trust

You’ll get that and more with State Farm life insurance. State Farm has fantastic policy choices to keep your family members safe with a policy that’s personalized to correspond with your specific needs. Luckily you won’t have to figure that out by yourself. With personal attention and outstanding customer service, State Farm Agent Dan Garber walks you through every step to set you up with a plan that protects your loved ones and everything you’ve planned for them.

Interested in experiencing what State Farm can do for you? Get in touch with agent Dan Garber today to get to know your personalized Life insurance options.

Have More Questions About Life Insurance?

Call Dan at (972) 621-1115 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.